SoFi SMB Banking

An all-in-one solution allowing Small Business Owners to make their banking needs seamless and proactively assist them with their needs, so that they can focus on running their business.

Est. $310M & 177K new customers in 5 years

TIMELINE & SCOPE

6-Week Product Validation & Investment Case

Aug - Sept 2023

4 weeks of research, concept definition, design iterations, and testing

2 weeks to deliver and present vision prototype

CORE TEAM

1 Venture General Manager

1 Product Manager

2 Design Researchers

2 Experience Designers

2 Strategy/Go-to-Market Consultants

8 People

MY ROLE

Led end-to-end Experience design work, from storytelling to design execution, to deliver vision prototype highlighting key features.

Developed testing assets, led interviews (team conducted 60+ total) to identify personas, pain points and key needs, and define feature.

Collaborated with multidisciplinary team to build product roadmap.

Mentored 1 Experience Designer and 1 Design Researcher.

Experience Design Owner

OPPORTUNITY

Small business banking is an attractive market ready to be disrupted.

44% of the US GDP and~$120B banking revenue pool comes from SMB banking and the segment continues to grow.

57% of SMBs are open to try a new bank solution and 30% are actively looking for one.

The SMB market is fragmented, with traditional players relying heavily on physical branches and fintech lacking the personal touch SMBs appreciate most.

Research Methods

28 Potential Members

3 Personas

Ages 23-55

Qualitative Research

744 Total Respondents:

527 Prospects

217 SoFi Members

Quantitative Survey

Reviewed lessons learned from top national banks and digital-first players

Evaluated value props from 4 best-in-class exemplars

Mapped our features against 8 competitors

Competitive Research

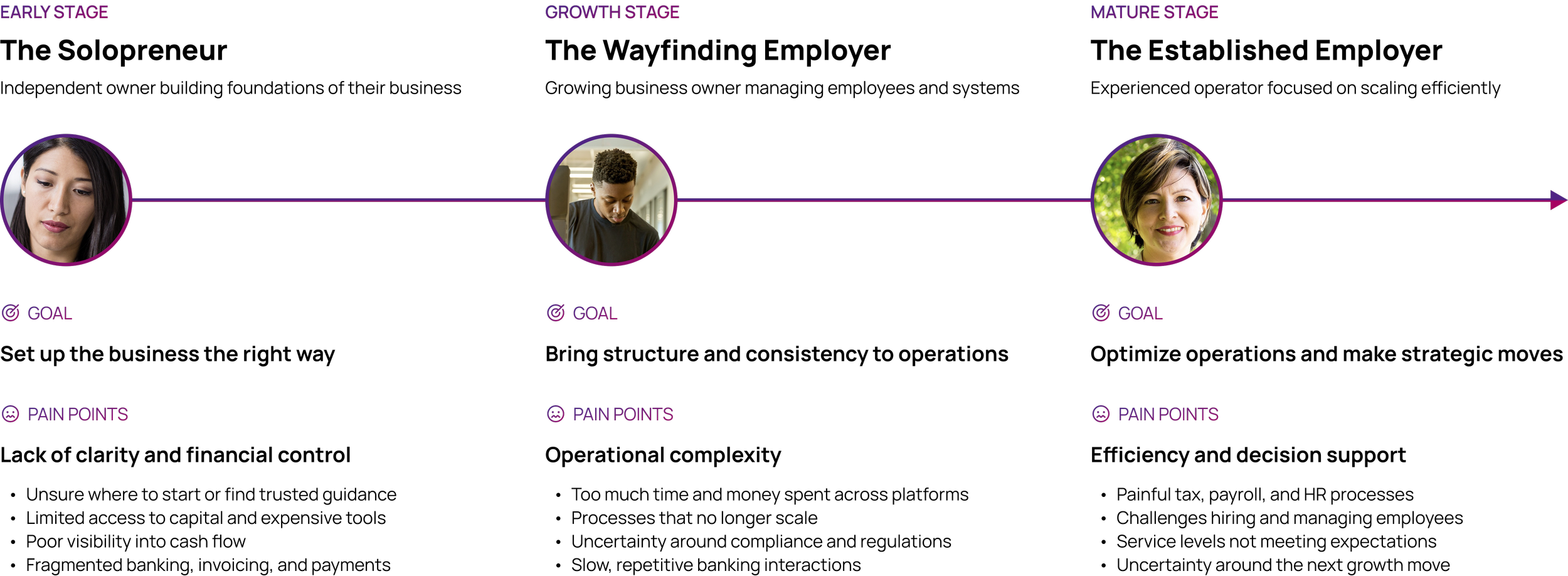

After our initial round of interviews, we identified 3 different personas with varying behaviors and needs.

ACTIONABLE INSIGHT 1

Small Business Owners are overwhelmed by manual processes and disconnected systems.

QUALITATIVE

“If everything could be in one dedicated place, that would be major. It would make everything streamlined so I can stop dealing with day to day finances and focus on growing my business.”

Jim B, Wayfinding Employer

QUANTITATIVE

17% of SoFi SMBs voice that their main challenge is spending too much time on admin tasks

#2 reason for not wanting to switch banks is keeping all of their banking in one place

ACTIONABLE INSIGHT 2

SMBs need reassurance and to know they are not alone

QUALITATIVE

“After COVID, I’ve learned I don’t always have to go to the branch. But I need a point of contact… that would make me more comfortable with an online-only solution.”

QUANTITATIVE

#1 reason for not wanting to use an Online-only bank (and SoFi in particular) is that they want the personal support they’re used to getting from local branch.

ACTIONABLE INSIGHT 3

SMBs do not feel supported in building credit and acquiring loans, which stunts growth.

QUALITATIVE

“Lending for your business, that sounds like something that we would definitely be looking for. That's why we want to switch to Bank of America… to get that 12 month application process started.”

QUANTITATIVE

44% of prospects are not likely to use an online-only bank that doesn’t offer lending, while 29% aren’t sure

60% of SMBs lack both a line of credit and a credit card

THE SOLUTION

Your business partner to help you cut through the grind so you can focus on what you do best.

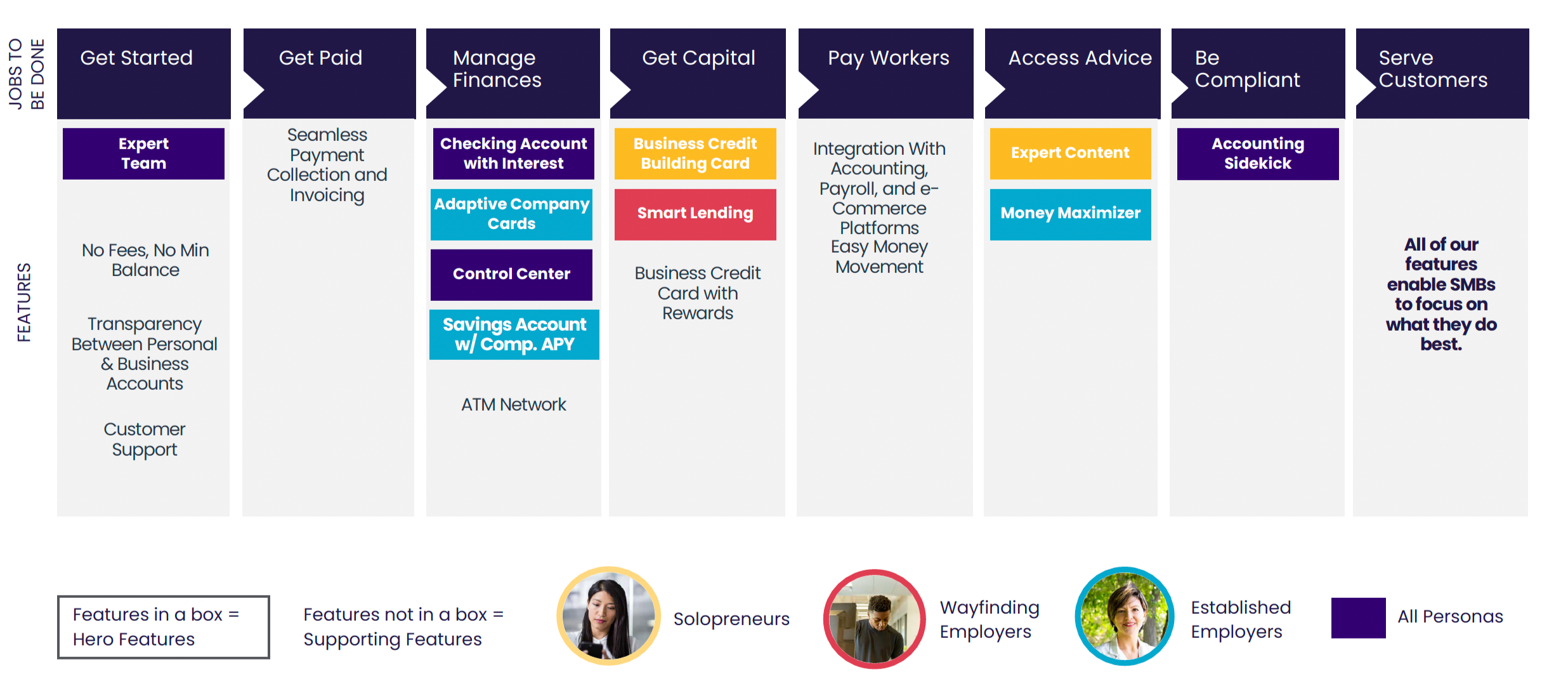

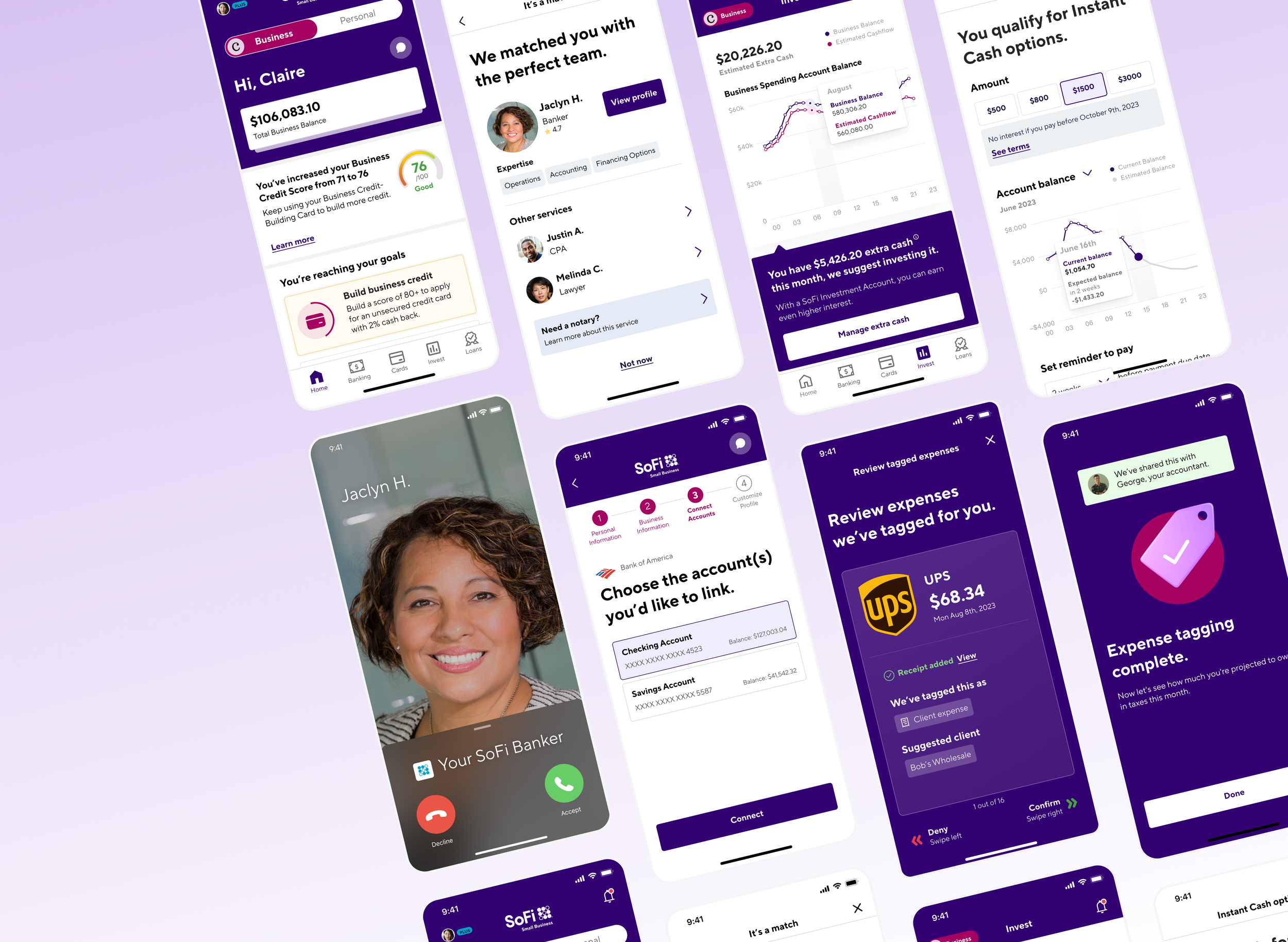

SOLOPRENEUR VISION PROTOTYPE

Let’s walk through Claire the Solopreneur’s experience with SoFi Small Business.

KEY FEATURES & CUSTOMER FEEDBACK

Spending Account with Competitive 1% APY

“I would be interested because of the interest rates.”

Expert Team (Banker, CPAs, Notaries & Lawyers) who know your business

“I especially love not calling and getting a random person at the call center… you’ll have a relationship and they’ll know your history, and that would make it feel more real.”

Expert Content (Tutorials, Articles, Webinars) to help you establish and grow your business

“I wish there was a guide because I had to figure this out on my own… SEO, graphic design, and creating an LLC.”

Secure Business Credit-Building Card, capped at the total amount in your account

“If it could report straight into Dun and Bradstreet and help build credit, that would be great. No one is telling me how to build business credit.”

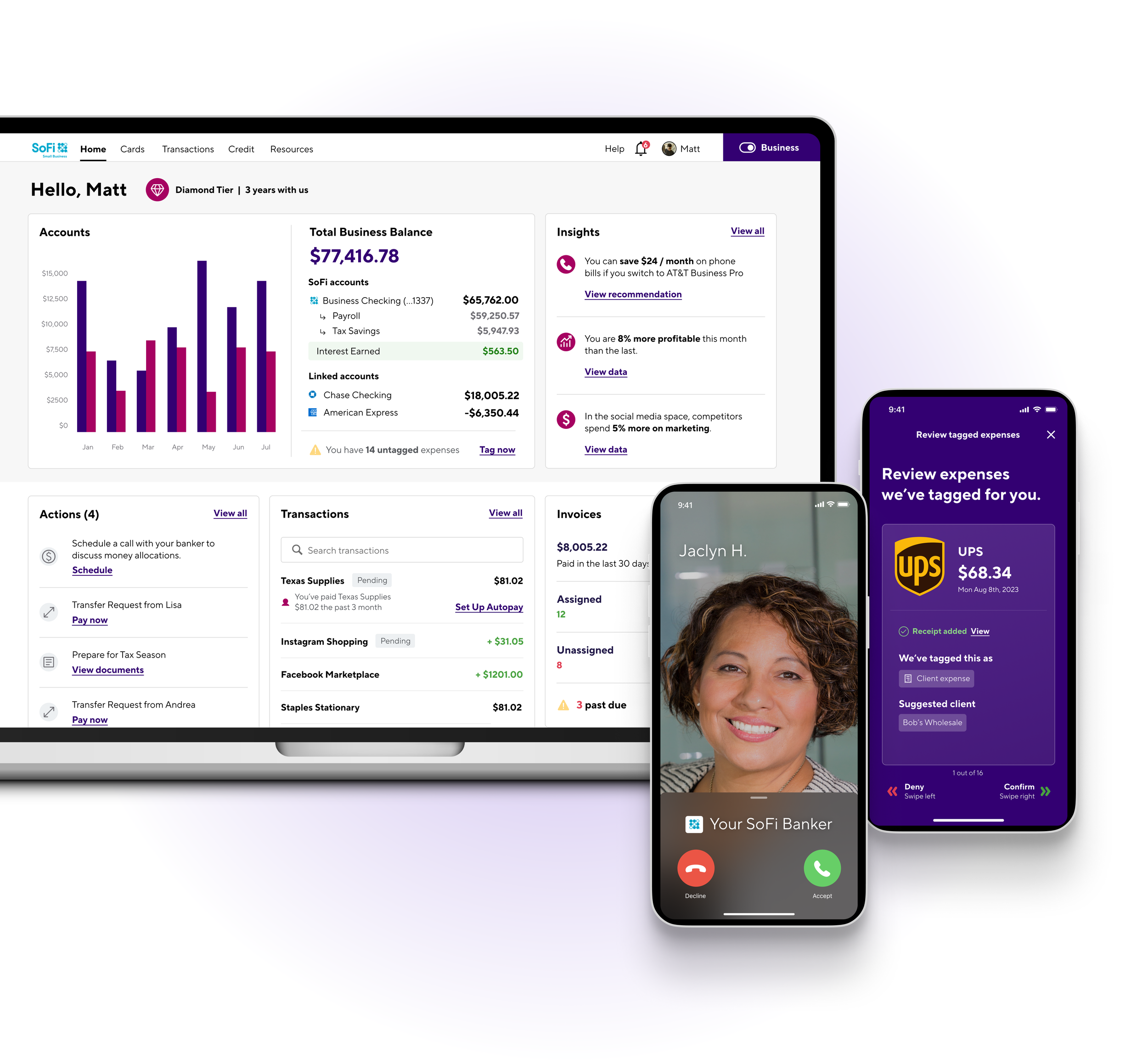

WAYFINDING EMPLOYER VISION PROTOTYPE

Now let’s see through Matt the Wayfinding Employer’s ideal experience.

KEY FEATURES & CUSTOMER FEEDBACK

Savings Account with Competitive 3% APY

“I like that there is interest on savings. Right now my savings APY is 1% but we’ve been moving a lot there because we’re saving to buy a new building”

Smart Lending - Instant Cash and Predictive Long-Term Loans

“It’s interesting to have checking and lending in the same entity because there is no one that knows my activity better than the bank. They can already see it, so this concept is great.”

Centralized view of all accounts with cash flow insights, team management, and actions to help the business grow

“I love this — sometimes in business, you don’t know what you don’t know. Seeing it in one place makes it easy to engage daily.”

Accounting Sidekick

“I’m really organized and have lots of tabs, calendars, and organization. Being able to create folders and move things would be great.”

ESTABLISHED EMPLOYER VISION PROTOTYPE

Finally, let’s check out Dr. Alexa the Established Employer’s journey.

KEY FEATURES & CUSTOMER FEEDBACK

Money Maximizer with investment recommendations

“I would love someone tell me what my investments look like and what my money is doing so I don’t need to worry about it.”

Adaptive Virtual Company Credit Cards with simple controls

“I started using Divvy over Amex because as I grow, I care more about business health than points — and employee cards help me organize.”

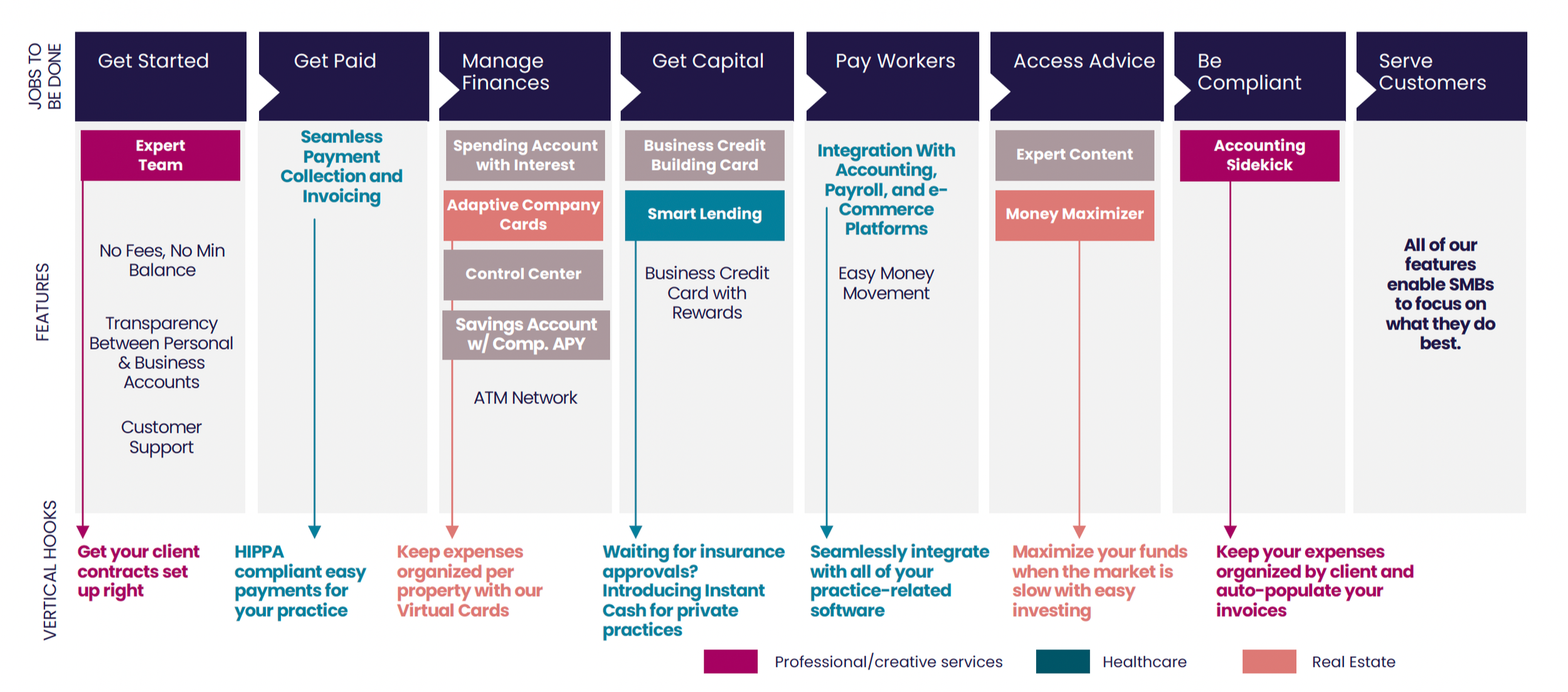

Our features solve the most acute pain points for each persona across their journey…

and can expand into vertical specialization over time for further differentiation.

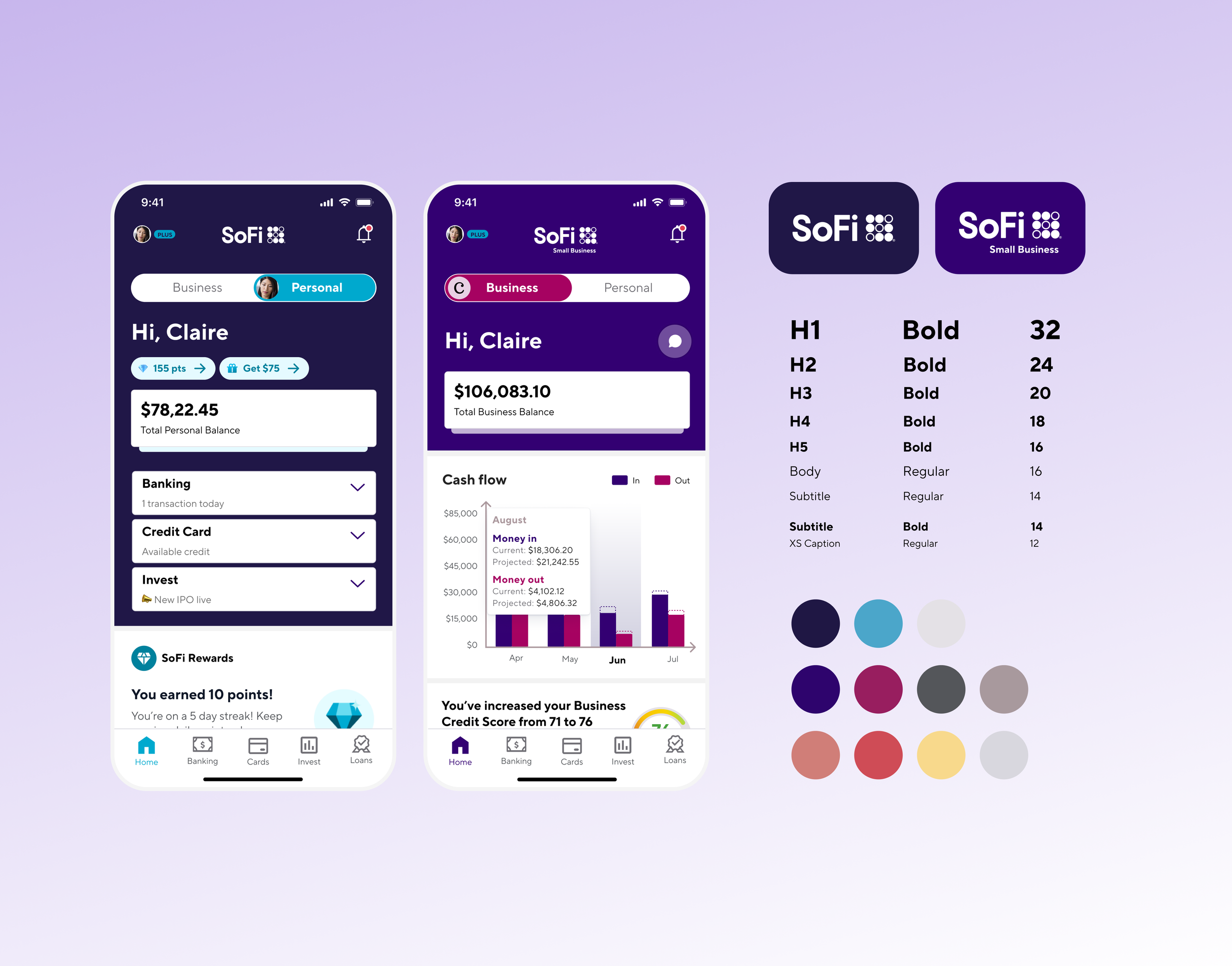

Integrated and adapted SoFi’s branding & UI

Users need all their banking in one place. I stayed consistent with SoFi’s Brand Identity and UI patterns to add the business offering into a customer’s app.

I created a mini-design system to replicate the UI assets SoFi had, and integrated a new identity to users’ business profile using their secondary colors, to differentiate their business from personal accounts.